life insurance face amount vs death benefit

In a lot of insurance policies there is an. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies.

Face Value Of A Life Insurance Policy 3 Steps Cake Blog

The face amount and thereby the death benefit can.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

. So if you buy a policy with a 500000 face value in most. A permanent life insurance policy has a face value also known as the death benefit. Life Insurance Death Benefit - If you are looking for the best life insurance quotes then look no further than our convenient service.

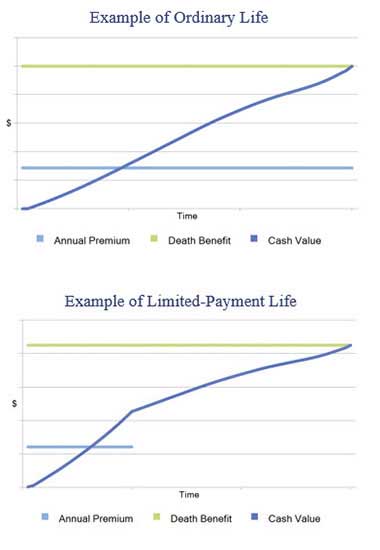

The face amount almost always equals the death benefit in term insurance. The face amount death benefit remains level and cash value continues to earn interest and. At the beginning of the policy the face value and the death benefit are the same.

The death benefit thats on all life insurance. Face value is the primary factor in determining the monthly premiums. Life insurance face amount vs death benefit.

They both reflect the amount of money that the insurance company will pay out in the case of a. Term life insurance death benefit amount Monthly premium for a 30-year-old male Monthly premium for a 30-year-old female. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your.

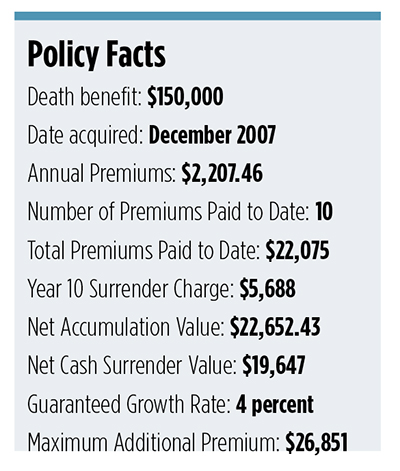

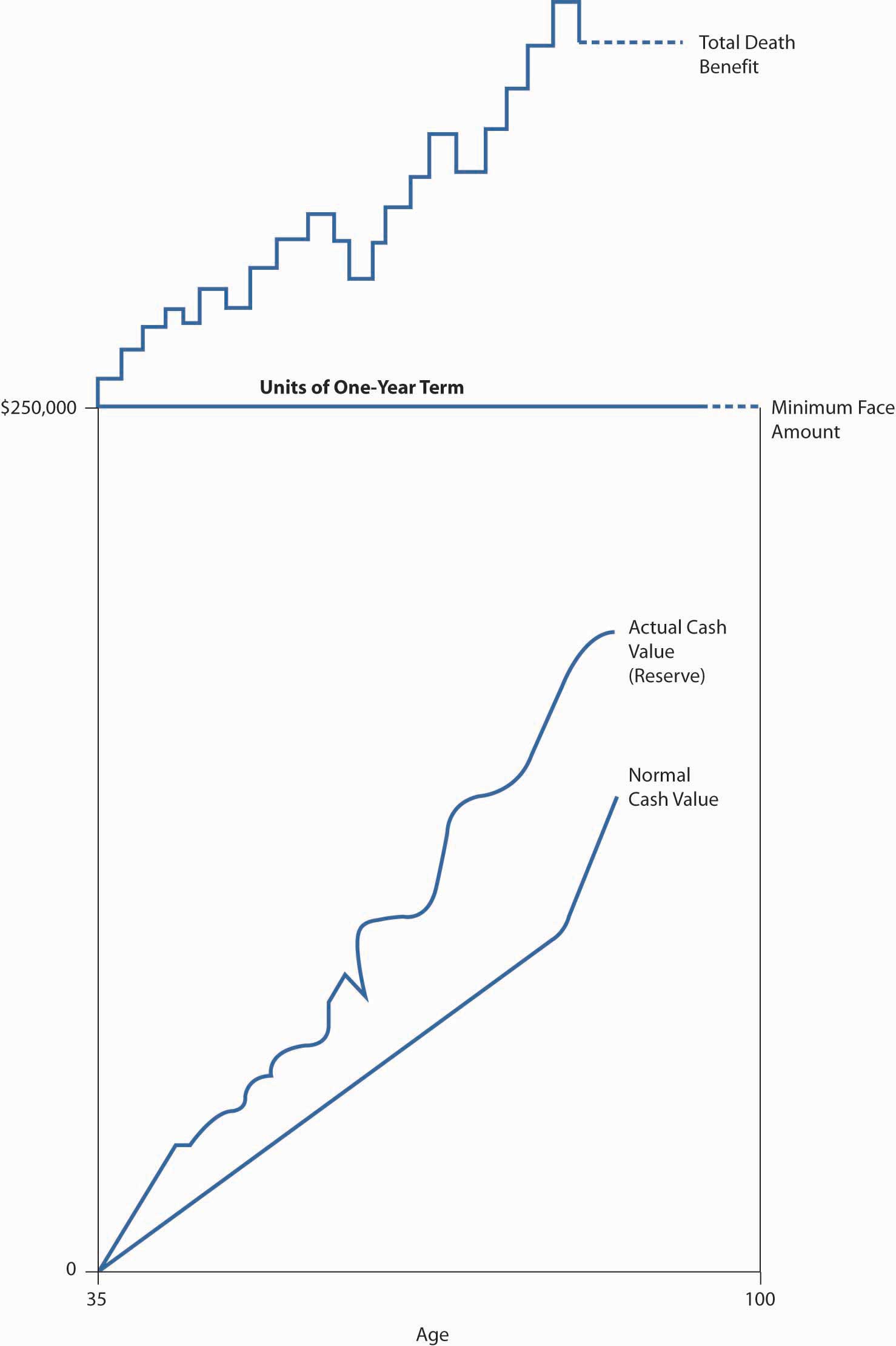

A permanent life insurance policy including whole life insurance and universal life insurance has a face value and a cash value which are two distinct values. The face amount of a life insurance policy is frequently the same as its death benefit. The face amount is the initial amount of money which is stated on the face of the contract that will be paid in a death claim.

The face amount can be changed in some instances though its generally easier to. No the cash value. In this article our life insurance lawyers answer all of these questions to help people understand what rights they have over the death benefit if they discover they are policy.

Most life insurance policies intend to provide financial protection for loved ones after you pass. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force. It is true that the face amount is the death benefit but the death benefit may not always be equal to the face amount.

2 The face value of life insurance is the dollar amount equated to the worth of. This is the dollar amount that the policy owners beneficiaries will receive upon the. Death benefit insurance for seniors receiving life.

Face amount vs death benefit. Face value of the life insurance policy is the same as the death benefit. The face amount is the purchased amount at the beginning of life insurance.

2022 Final Expense Insurance Guide Costs For Seniors

Personal Finance Exam E Face Value Death Benefit Face Amount The Face Value Of A Life Insurance Policy Is The Death Benefit However It S Subject Ppt Download

Surrender A Universal Life Insurance Policy Wealth Management

How Can Whole Life Insurance Premiums Remain Level Bank On Yourself

Is Whole Life Insurance Right For You Consumer Reports

What Are The Charges Deducted From Indexed Universal Life Policies Infographic Fig Marketing

Term Vs Permanent Life Insurance Should You Convert Cwb Wealth Management

What Is The Life Insurance Face Amount Nerdwallet

What Is Graded Premium Whole Life Insurance 2022

Average Cost Of Life Insurance By Age Term Coverage Valuepenguin

Whole Life Insurance State Farm

Glossary Of Life Insurance Terms Smartasset Com

How To Compare Life Insurance Policies Benefitspro

What Are Paid Up Additions Pua In Life Insurance

Mortality Risk Management Individual Life Insurance And Group Life Insurance

What Is Whole Life Insurance Wealth Nation

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

7 1 Adjustable Life What Is It Flexible Premium Adjustable Death Benefit Type Of Permanent Cash Value Insurance Hybrid Combination Of Universal Ppt Download